General Liability

Seeing the Whole Picture. Acting with Precision.

The Veritas Advantage in General Liability

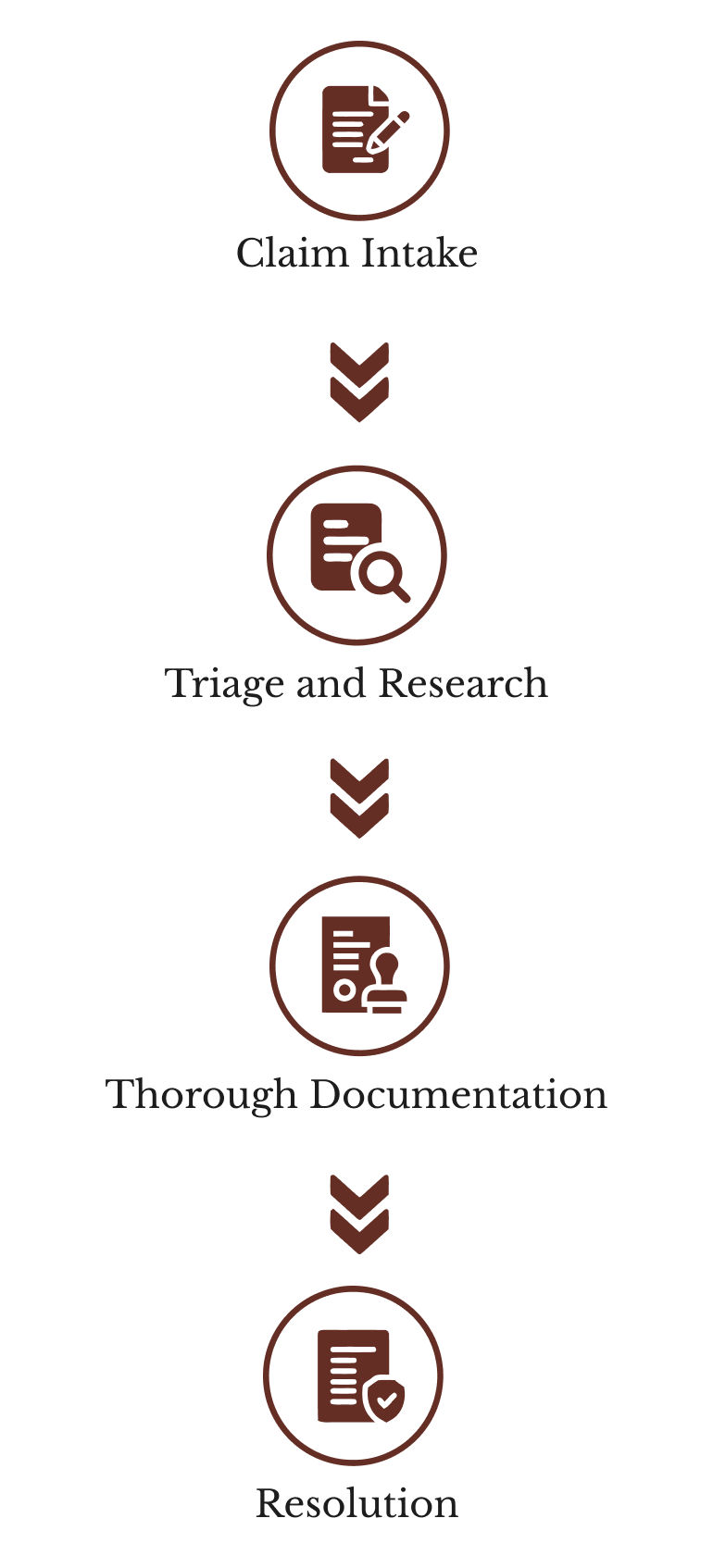

- Evidence and statements are gathered promptly to avoid gaps in documentation.

- Subrogation and contribution opportunities are identified early, ensuring recovery potential is never overlooked.

- Legal exposures are addressed before they escalate, supported by coordination with cargo, towing, and subrogation specialists when incidents cross into those domains.

- Clients receive consistent communication, supported by dedicated points of contact who maintain oversight from start to finish.

Turning Liability Management into a Strategic Advantage

Over time, clients find that recoveries and savings in GL offset the costs of other services—turning liability management from a cost center into a strategic advantage. By pairing speed with defensibility, Veritas ensures outcomes that strengthen client performance and reduce total cost of risk.

Broader trends are also reshaping general liability management:

- Litigation is expanding, with broader allegations against general liability carriers.

- AI and surveillance are improving defensibility, but require skilled review to use effectively.

- Public expectations for speed and clarity are now performance benchmarks in their own right.

Real Returns, Real Feedback

Veritas’ GL team has consistently delivered outcomes that exceed expectations. In one case, a complex property damage dispute was resolved efficiently, with both the claimant and carrier acknowledging the precision of the resolution.

Client feedback reflects the results:

“That’s awesome. Great catch and thank you. This file could have dragged out much longer.”

“I received the signed release and issued payment. Everything was clear and timely.”

“Kudos to your team—quick service on a messy liability file. I never had to ask for a status.”

“You kept the process moving and kept us informed at every step. That makes the difference.”

General liability claims are rarely simple, and their costs are rising. With average bodily injury claims surpassing $24,000, litigation expenses climbing by double digits, and delayed resolutions inflating costs by 30 percent or more, carriers cannot afford generic approaches.

Veritas brings together heavy equipment and commercial trucking expertise, nationwide coverage with customized solutions, and complete claim handling across every line—a model that turns general liability claims from volatile risks into controlled, defensible outcomes.